flow-through entity tax form

Branches for United States Tax Withholding provided by a foreign intermediary or flow-through entity must be accompanied by additional information for you to be able to reliably associate the payment with a payee. Qualified taxpayers can claim the credit on their personal income tax return.

This guidance is expected to be published in early January 2022 and will be posted to the Departments website.

. Of the owners personal income tax return flow-through entities like S Corporations or Partnerships are generally required to. 1 00 Schedule A Pass-through entity tax PTET paid on your behalf see instructions Submit this form with Form IT-201 IT-203 or IT-205. Reporting Non-electing Flow-Through Entity Income Form 5774 Schedule for Reporting Member Information for a Flow-Through Entity Do not send copies of K-1s.

An entity in which partners are not personally liable for the companys debt obligations. A pass-through entity is an entity whose income loss deductions and credits flow through to members for Massachusetts tax purposes. Advantages of a Flow-Through Entity.

Ataxpayer may be eligible. The deduction limits apply both to the business entity and the owner. This legislation was passed as a workaround to the federal 10000 state and local tax deduction limitation that has frustrated many business owners since it was passed in 2017 as part of the Tax Cuts and Jobs Act.

To file a PTET annual return. AR1155 Pass-Through Entity Extension Request. For further questions please contact the Business Taxes Division at 517-636-6925 and follow the prompts for Corporate Income TaxFlow-Through Entity.

Some internet browsers have a built in PDF viewer that may not be compatible with our forms. Form W-8 IMY may serve to establish foreign status for purposes of sections 1441 1442 and 1446. There are three main types of flow-through entities.

An electing entity and certain responsible persons will be liable for any unpaid tax due under Article 24-A see Tax Law 866c. The information in this section also applies if for the 1994 tax year you filed Form. The income of the owners of flow-through entities are taxed using the ordinary.

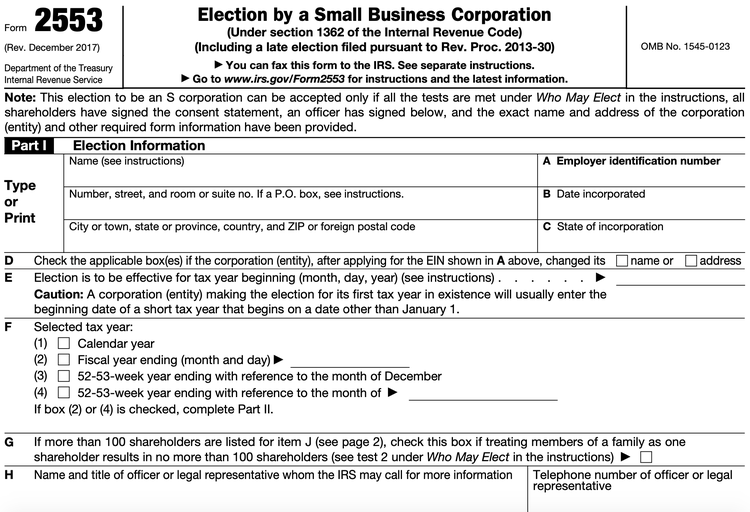

The following are all pass-through entities. A flow-through entity is also called a pass-through entity. The flow-through entity tax annual return is required to be filed by the last day of the third month after the end of the taxpayers tax year.

There are two major reasons why owners choose a flow-through entity. Through entity receiving a payment from the entity I certify that the entity has obtained or will obtain documentation sufficient to establish each such intermediary or flow-through entity status as a participating FFI registered deemed-compliant FFI or FFI that is. 2021 Flow-Through Entity Tax Annual Return Form Warning Save functionality for FTE returns is forthcoming in the meantime enter all return data in one session.

Governor Whitmer signed HB. Flow-Through Entity Tax Ask A Question Figures Needed for FTE Reporting Frequently Asked Questions Report and Pay FTE. Types of flow-through entities.

1 MCL 206841 6. The owner then adds up all 179 expenses passed through to himher from all business entities. The PTET entity must file the return online through the entitys Business Online Services account.

Each entity calculates its 179 expenses and applies the limit. Flow-through Entity Tax Credit. AR1100PET Pass-Through Entity Tax Return.

The Form W-8IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation. AR1100PTV Pass-Through Entity Payment Voucher.

Form 5773 Non-electing Flow-Through Entity Income Template. S corporation S corp. A business owned and operated by a single individual.

Limited liability corporation LLC. We are developing the following tax forms for qualified entities to make the PTE elective tax payments and for qualified taxpayers to claim the tax credit. 5376 on December 20 2021 enacting a flow-through entity tax for those doing business in Michigan.

It allows ownersshareholders to receive higher net returns on their investment. The entitys income only goes through a single layer of tax rather than two corporate tax and shareholder tax. A member of a flow-through entity that elected to pay the Michigan flow-through entity tax may claim a refundable credit and will report an addition.

Refunds received under the flow-through entity tax or city income tax Income from the production of oil and gas Income derived from a mineral Miscellaneous subtractions. Form 5774 Part 1 Corporations Insurance. Branches for United States Tax Withholding and Reporting including recent updates related forms and instructions on how to file.

Information about Form W-8 IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. See instructions for MI-1040 line29 on page 10 and Schedule 1 line 2 on page 12. The income of the business entity is the same as the income of the owners or investors.

A form of LLC in which ownership is limited to certain. What form to file. Pass-through Entity Tax Instructions.

AR1100ES PET Pass-Through Entity Estimated Tax Vouchers. 653001210094 Department of Taxation and Finance IT-653 Pass-Through Entity Tax Credit Tax Law Section 606kkk 1Add column C amounts see instructions. This section provides information on the types of investments that are considered flow-through entities and how to calculate the capital gain and loss resulting from the disposition of shares of or interests in a flow-through entity.

As part of the electronically filed Schedule 3K-1 and SK-1 forms the pass-through entity will be asked to provide information identifying the member as an. For calendar filers that date. Deduction for Wagering Losses.

The expenses subject to the limit are then passed through to the owner. Pass-Through Entity Elective Tax Payment Voucher FTB 3893. Form IT-653 Pass-Through Entity Tax Credit Tax Year 2021 IT-653 Department of Taxation and Finance Pass-Through Entity Tax Credit Tax Law Section 606kkk Submit this form with Form IT-201 IT-203 or IT-205.

Log in to the eligible entitys Business Online Services account.

Hybrid Entities And Reverse Hybrid Entities International Tax Blog

Pass Through Taxation What Small Business Owners Need To Know

Pass Through Entity Tax 101 Baker Tilly

/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

Flow Through Entity Overview Types Advantages

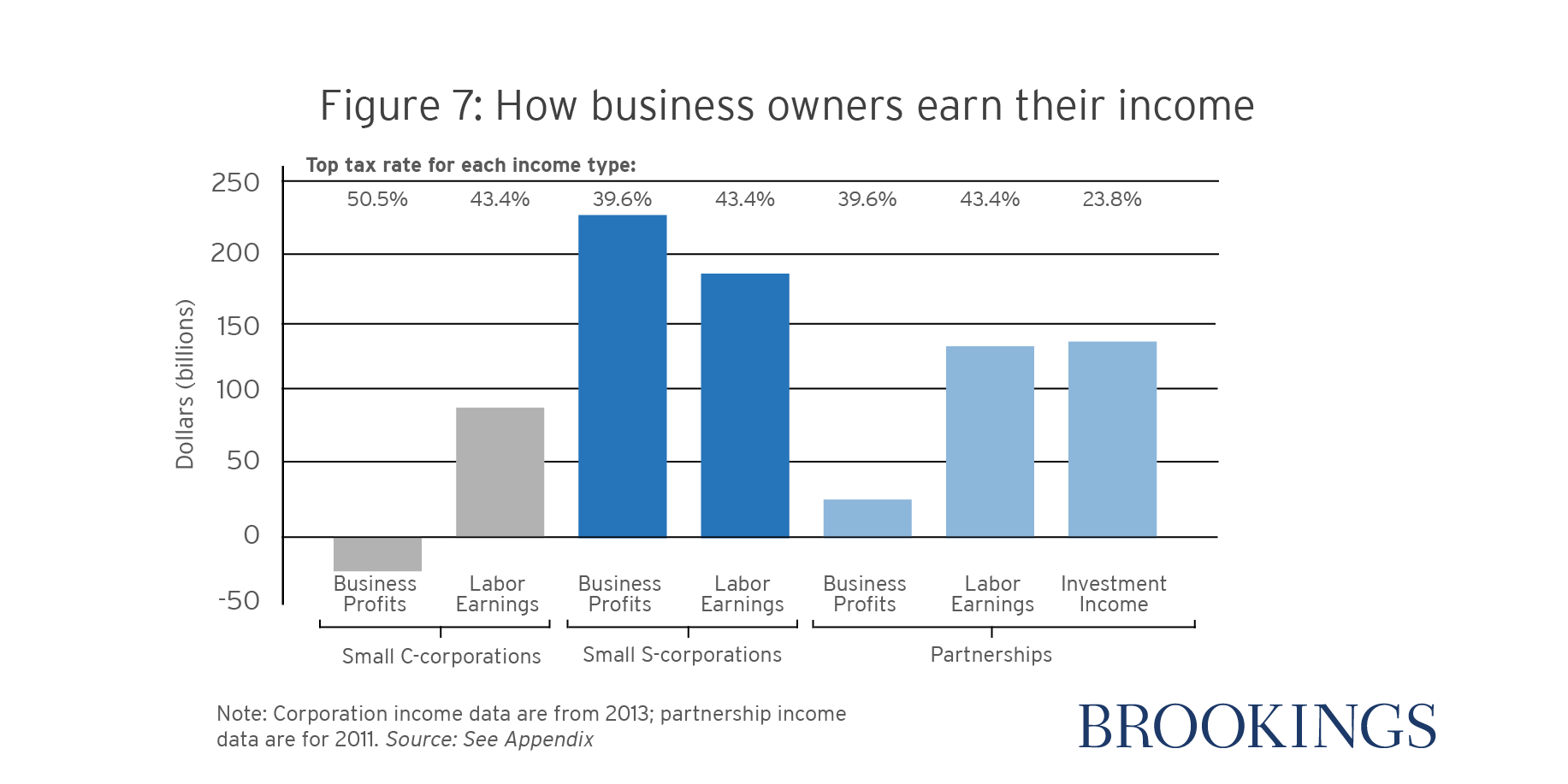

9 Facts About Pass Through Businesses

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

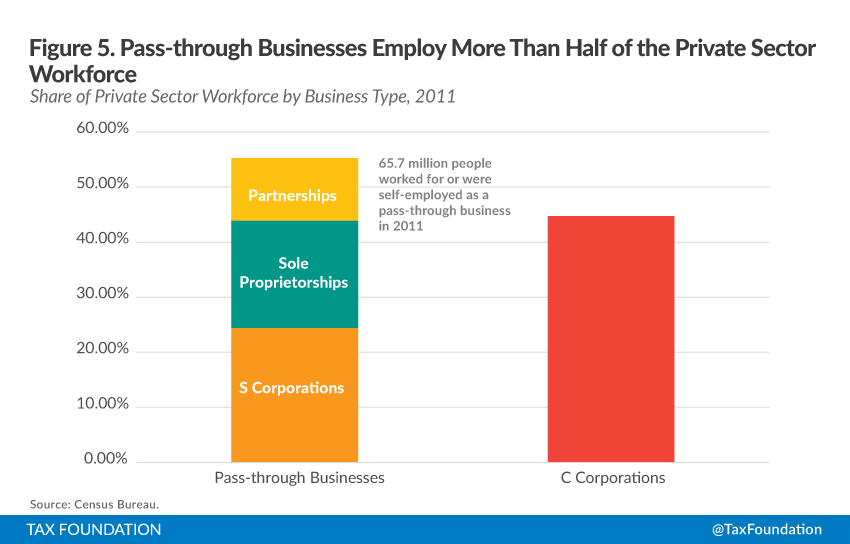

An Overview Of Pass Through Businesses In The United States Tax Foundation

A Beginner S Guide To Pass Through Entities

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

Pass Through Entity Definition Examples Advantages Disadvantages

Tax Guide For Pass Through Entities Mass Gov

/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

Pass Through Entities Fiduciaries Composite Return It 4708 Department Of Taxation